Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“As we start the new year, it’s a muted one for the UK jobs market. December’s data shows weakening demand causing the biggest contraction in vacancies since August 2020, coupled with hiring intention declining at a pace not seen for 16 months.

“The hiring market could continue to show signs of caution in the short-term, as businesses pause to take stock of higher employment costs, a more gradual pace of interest rate cuts and rising inflation.

“However, as 2025 progresses and UK economic growth picks up, businesses will need new talent. Salary inflation being at its steepest in four months shows they are still willing to compete for it.

“Chief Execs will certainly also be counting on new policies which support their 2025 growth ambitions and boost confidence to invest.”

Neil Carberry, REC Chief Executive, said:

“This report emphasises a weak mood in some businesses as they built their budgets for this year, and made changes designed to save on costs after a tough Budget. That said, sentiment can change quickly. December is always a hiring low point, and a new year brings new hope – with inflation under control, low unemployment and economic growth expected, the fundamentals are better than many appreciate. It is what happens now, as firms return to the market in January, that will decide the path ahead. Recruitment is one to watch in early 2025 because it is one of the earliest indicators of a broader economic recovery, with any sign of a turn hugely significant with the sector contributing a massive £44.4bn to the UK economy in 2023.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for December are:

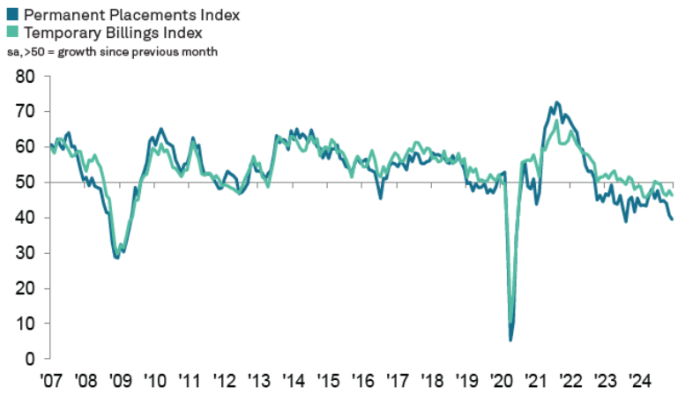

Accelerated fall in permanent placements signalled in December

The end of 2024 saw the fastest decline in permanent placements since August 2023, according to the latest KPMG/REC Report on Jobs survey. Respondents noted a lack of market demand for candidates amid evidence of a growing cost consciousness amongst firms especially in the context of the recent government Budget and the announced rise in employee National Insurance contributions. Temp billings similarly declined in December, and to a greater extent than typically seen during 2024.

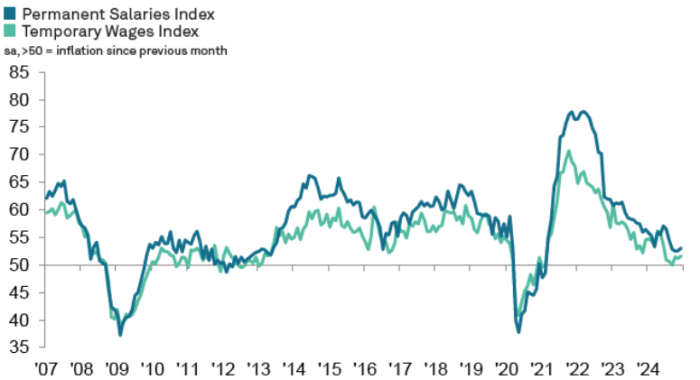

Upturn in permanent salary pay recorded in December

Despite a drop in permanent placements, there was an acceleration in the rate of starting salary inflation during December as firms remained willing to raise pay for high quality staff (and in some instances as part of talent retention programmes). Overall, the increase in perm salaries was the best in four months, although inflation remained well below trend. Similarly, temp pay rates rose modestly in December amid reports that a high supply of candidates was limiting pay inflation.

Vacancies continue to contract sharply

In December, vacancy numbers declined again, with the rate of contraction picking up since November to the steepest recorded in well over four years. Permanent staff saw the biggest drop in demand since August 2020. Although not as severe as perm workers, the decline for temp staff was the greatest in four-and-a-half years.

Staff availability rises at an accelerated pace

Recruitment consultants reported another steep increase in staff availability during December. Overall, the expansion in availability was the sharpest since June. The upturn in growth was primarily driven by the permanent staff category, although temp worker availability also rose sharply at the end of 2024.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Pay Pressures

The recruitment industry survey tracks both the average salaries awarded to people placed in permanent jobs each month, as well as average hourly rates of pay for temp/contract staff.

Faster rise in permanent salaries recorded

Permanent salaries increased again during December, in line with the trend recorded by the survey since March 2021. Although remaining well below the survey’s historical trend, the rate of inflation picked up to a four-month high. Panellists reported that competition for high quality candidates had raised starting salaries. However, an increase in the supply of candidates somewhat limited salary growth, according to panellists. By English region, London recorded the steepest increases in starting salaries. In contrast, there was a decline in the South of England.

Temp pay rates rise modestly

A third successive monthly increase in temp rates was recorded by December’s survey. Inflation was modest, through still the highest seen since June. Higher pay rates were reportedly being used to attract candidates, although the increased availability of workers served to restrict the pace of inflation. Modest pay increases were seen in the Midlands and the North of England. A solid rise in temp pay was recorded in London, in contrast to a decline seen in the South of England.

Insights for the South of England

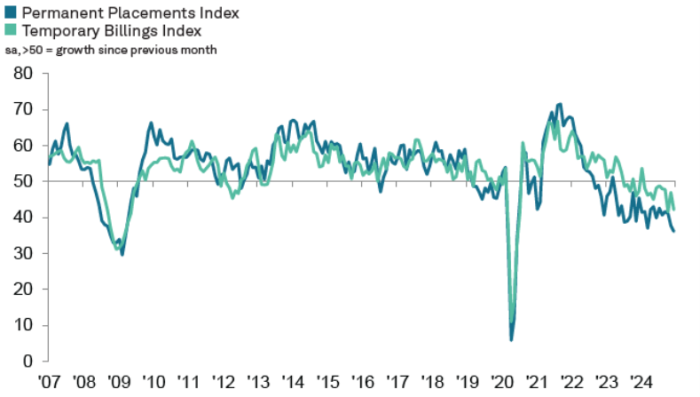

2024 ends with pronounced drop in recruitment activity

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit have reported a sharper decline in both permanent appointments and temporary billings. Starting salaries are falling at their fastest rate since February 2021, reflecting growing economic pressures. Meanwhile, ongoing redundancies are contributing to an oversupply of candidates, reshaping the dynamics of the job market.

Commenting on the latest survey results, Emma Gibson, Office Senior Partner for KPMG Reading said:

“It’s not an easy time for jobseekers in the South of England, with December marking the steepest decline in new, permanent positions in four-and-a-half years. That said, despite the ongoing impact of increased tax considerations for employers, we know from our KPMG Private Enterprise Barometer that businesses across the UK have ambitious plans for the year ahead and are confident of growth.

“Salaries in the South also saw the most substantial drop since early 2021 – the only part of the UK to see a fall – so employers in the South will be able to strengthen their teams at a competitive rate.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Staff Availability

Rapid expansion in permanent staff supply

Recruiters in the South of England reported another month of rapidly increasing permanent staff supply in December. The rate of growth was the fastest in four months, although it was still behind the UK-wide average. According to panellists, redundancies and a decrease in open vacancies were the primary factors contributing to this latest rise in staff supply.

Marked but slightly softer expansion in temp staff supply

December saw a rise in the supply of temp staff available across the South of England, thereby extending the current growth period to 20 months. While the rate of increase eased to a three-month low and indicated the weakest expansion among the four monitored English regions, it remained rapid overall. Survey respondents noted that redundancies were the primary driver of increased temp candidate numbers.

Summary

As we step into the new month, the recruitment landscape continues to evolve, shaped by shifting market dynamics and economic pressures. Reports from UK companies indicate growing cost concerns and redundancy measures, underscoring the need for strategic workforce planning. However, amidst these challenges, pay levels for high-quality candidates continue to rise, reflecting the ongoing demand for exceptional talent. Encouragingly, staff availability has increased to its highest level in six months, offering opportunities to secure skilled professionals in a more competitive hiring environment. This month’s newsletter provides insights to help you navigate these trends effectively and stay ahead in attracting and retaining top talent.

To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.