Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“Uncertainty over the Autumn Budget saw businesses continue to put hiring plans on hold during October leading to the steepest contraction in permanent staff appointments since March. But employers didn’t turn to temporary staff to fill gaps, with these appointments also facing their biggest reduction in seven months.

“While businesses are still willing to pay more for top talent, the growing pool of available candidates means salary inflation was at its weakest since early 2021. The Bank’s Monetary Policy Committee will have considered this trend in their meeting on Thursday.

“With many of the tax rises announced in last week’s Budget impacting businesses, the expectation from some chief execs is that this could further dampen hiring as companies grapple with absorbing any extra costs. However, with the Office for Budget Responsibility forecasting a rise in productivity and a Budget that signalled more long-term policy making, businesses may feel that this all brings some degree of certainty.”

Neil Carberry, REC Chief Executive, said:

“These figures are a timely reminder that demand from employers for new staff has weakened since the election – though the overall picture remains resilient by comparison to pre-pandemic. There are a few positive signs in this month’s data – like more robust performance in London, which is often a bellwether. But things now stand in the balance – firms need to be persuaded to invest, with recent changes to NI thresholds, the minimum wage and prospective changes to employment law all causing concern. Firms will be looking for the Government to deliver a clear, stable growth plan and detailed regulatory changes that enable firms rather than put them off over the next few months. Temporary work in particular is a fantastic way of helping people take steps out of inactivity, and the threat of new employment laws undermining opportunities for workers must be addressed.

“There is little in the pay data in today’s report that suggests the Bank of England should step away from further cuts to interest rates, which will also boost business confidence. And data on shortage sectors is a timely reminder that delivering on a skill strategy that is aligned to business needs is one of the biggest things Government and businesses could achieve working together.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for October are:

October sees further decline in staff appointments

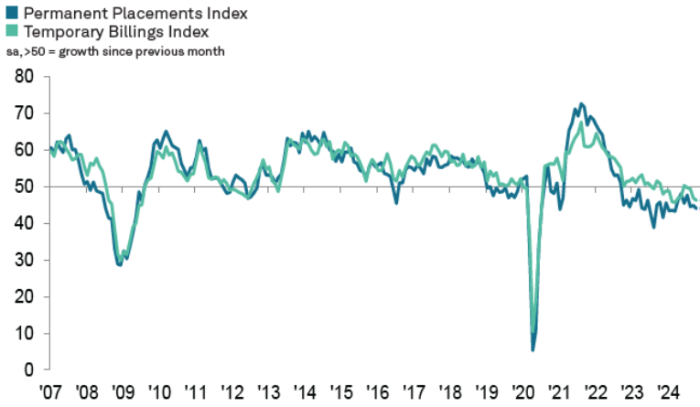

The KPMG/REC Report on Jobs survey signalled a further decline in permanent placements during October, extending the current period of contraction to over two years. The rate of contraction also accelerated, reaching its steepest since March. There were reports of recruitment freezes at firms amid ongoing business uncertainty ahead of the late October government Budget. Similar factors led to the steepest reduction in temp billings for seven months.

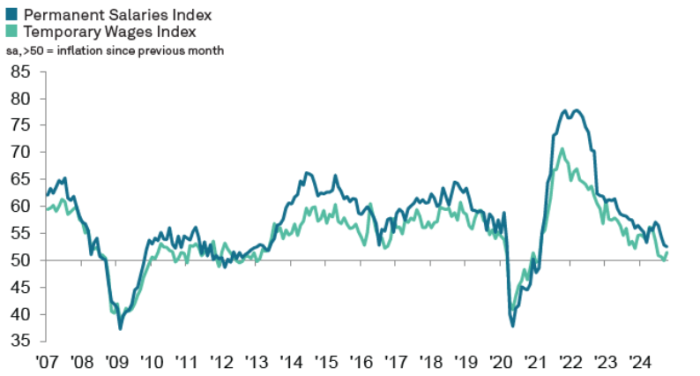

Permanent salary growth continues to soften in October

Permanent pay growth sustained its recent downturn in October, falling to its lowest level since February 2021. Although some firms were willing to raise starting salaries for high quality candidates, increased staff availability and reduced demand for workers weighed on growth. Temp rates meanwhile increased following little change in September, but the rate of growth was modest and well below the survey’s historical trend level.

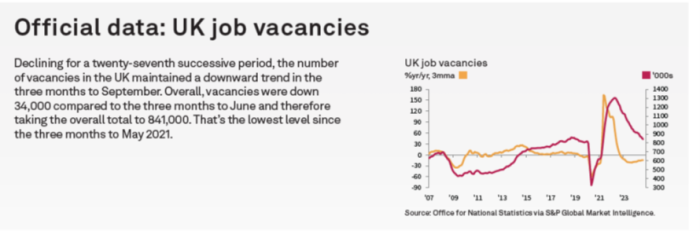

Vacancies fall at accelerated rate

Demand for staff continued to decline during October, falling for a twelfth successive month. The rate of contraction also picked up, reaching its steepest since the start of 2021. Once again, declines in vacancies were common for both permanent and temporary staff workers.

Staff availability rises again

The overall availability of staff continued to increase steeply during October. Lower demand for workers and reports of redundancies underpinned the twentieth successive monthly rise in availability. The increase in temps was notable in being the sharpest recorded by the survey since December 2020.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Insights for the South of England

South of England jobs market faces challenges

The latest UK Report on Jobs from REC, KPMG, and IHS Markit reveals a significant decline in temporary billings, and the overall demand for workers deteriorates at the strongest rate since the summer of 2020, suggesting a challenging job market. Additionally, an oversupply of staff is contributing to a slowdown in pay growth.

Commenting on the latest survey results, Emma Gibson, KPMG UK Reading office senior partner, said:

“The continued decline in both permanent hires and temporary billings reflects the caution businesses are exercising in the South, which saw the steepest drop in vacancies nationwide last month as firms pulled back on hiring ahead of the Autumn Budget.

“Looking ahead, it’s unlikely that businesses will rush to bring on new teams, with the recent National Insurance rise creating new considerations for employers. These factors heighten both the cost and potential risk of hiring, which will likely see companies in the South East re-evaluate their talent needs heading into the new year.”

Staff Availability

Permanent staff rises sharply

Permanent staff availability rose for a twentieth consecutive month across the South of England in October. The rate of growth picked up from September’s 12-month low and was rapid overall. Recruiters surveyed indicated that redundancies were the primary factor contributing to this latest increase.

Temp candidate availability expands substantially

Latest survey data indicated a rise in temporary staff supply across the South of England, thereby extending the current growth trend that began in May 2023. The rate of expansion accelerated from September, reflecting a significant increase in temporary staff availability. Respondents frequently pointed to fewer vacancies, redundancies, and a cautious hiring environment as the key reasons behind this increase.

Special Feature

This section features data from the Recruitment and Employment Confederation

Turn to interns for motivated and bright talent

Financial pressures are biting businesses which makes it inevitable that many question the value of investing in interns, especially short-term ones. But that ignores the potential benefits of flexible interns to their business, their sector and the wider economy.

After all, taking on interns demonstrates a company’s dedication to nurturing talent and contributing to the professional growth of the next generation of workers. People are the engine of our economy and a commitment to interns creates the kind of pipeline of skilled, motivated individuals that can help economic growth.

People want to intern and are looking for roles all the time – and it is up to businesses to take advantage and do their bit for nurturing talent. Google searches for “internships 2025” began in mid-June 2024, highlighting that young people are already considering their next steps. Employers who hire interns should take note of this trend and prepare accordingly. Recent data from Prospects, a graduate career specialist, shows that 30% of young people have looked for an internship in the past 12 months, with 17% having completed one.

There is a need for more accessible internship opportunities and supportive entry points into the job market. The same Prospects survey found that nearly one third (28%) of respondents had turned to recruiters for help landing their internships. Showcasing the vital role that recruiters play in shaping the graduate landscape.

Among those seeking internships, 66% were university students, 17% were employed or self-employed, and 13% were neither working nor studying. Yet a significant 68% reported difficulties in finding opportunities to apply for, while 58% were concerned about lacking the necessary work experience.

Data from the Recruitment and Employment Confederation (REC) and Lightcast shows there were 4,156 internship postings in the UK as of September 2024. While this number is substantial, it represents a 6.4% decrease compared to February 2020, pre-pandemic. This decline suggests that there is room for improvement in providing internship opportunities across various industries.

Industries with the highest number of internship adverts posted in September were Professional, Scientific and Technical Activities (591) and Manufacturing industries (523). Both industries increased the number of internships available as compared to pre-pandemic, 11.7% and 30.1% respectively. This shows that there is an appetite to build a more sustainable and larger pipeline of workers interested in these areas.

Whilst it is expected that most internships are within the private sector, there should be more opportunities in other critical sectors such as Human Health and Social Work Activities, which lags behind, posting fewer than 100 opportunities in September 2024.

Investing in internships offers long-term benefits for both businesses and young professionals. It fosters a positive brand image, meets the growing demand for professional development opportunities, and addresses the challenges faced by aspiring interns. By committing to this investment, companies can cultivate a skilled workforce and secure their position as industry leaders.

At Jo Thompson Recruitment, we communicate seamlessly with hiring managers, fuel collaboration by sharing information and insights. Hiring managers are time-poor, so providing pre-qualified candidates with data driven insights and creating the resilient, agile and diverse workforce you need to succeed is a major win.

We can support you to refine your data-driven recruitment strategy and tailor your approach to each target audience. Help you make informed talent decisions around diversity and hidden talent pools. To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.