Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“Persistent economic uncertainty has led to many business leaders delaying major investment decisions and relying on savings for growth during the first quarter of the year. But they are optimistic about the outlook improving.

“And while March’s survey data indicates ongoing weak demand in the labour market with a sharp rise in candidate availability, relatively low levels of UK unemployment together with falling inflation could pave the way for economic recovery.

“There are still headwinds, but it’s time for the UK economy to get its groove back – and UK businesses will be ready when the Bank of England makes its interest rate cuts. This may not lead to an instant rebound, but confidence to invest will increase, improving demand, and the economic outlook should start moving in the right direction.”

Neil Carberry, REC Chief Executive, said:

“Economic growth has been sidelined for too long and must be at the heart of this year’s General Election campaign. Today’s data shows the economy in a holding pattern waiting for inflation and interest rates to ease, so that firms can get to investing. The decline in permanent placements has been steady for some months now, with temporary recruitment still robust, if falling back from the record highs of 2022/3. Employers appear to be leaning on temporary work while they are uncertain about the path of the economy.

“The data here should support a decision by the Bank of England’s Monetary Policy Committee to loosen its grip on growth in the near-term future. Pay growth has slowed significantly and is now below the survey’s long-term average for new permanent roles. Some sectors – like the bellwether firms in construction – need a clear signal. In other areas, particularly engineering, demand remains high, emphasising the importance of a new approach to skills from governments across the UK, led by reform of the Apprenticeship Levy. The uptick in the need for blue collar staff may be a sign of consumer confidence starting to return – but it also emphasises again how labour shortages may constrain growth when it returns. A proper industrial strategy, with a meaningful and practical workforce element to it, is long overdue.”

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for March are:

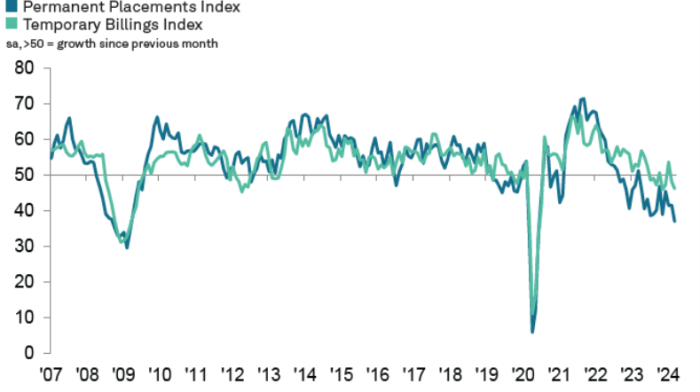

Recruitment activity continues to decline in March

Permanent staff appointments in the UK continued to fall in March, extending the current downturn to a year-and-a-half. An uncertain economic outlook and ongoing recruitment freezes were reported by recruiters as reasons for the latest decline. Budget constraints also reportedly weighed on temp billings during March, which fell to the steepest degree since July 2020.

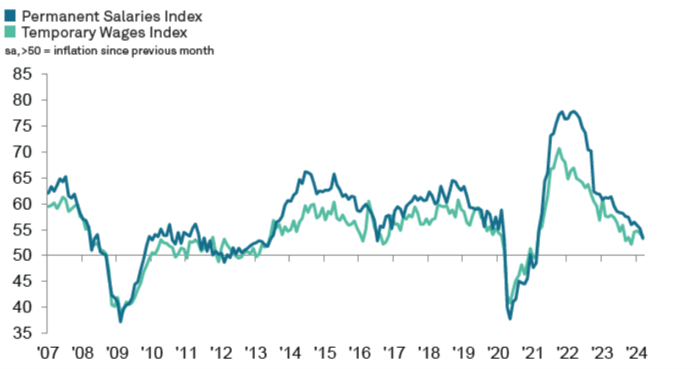

Permanent staff pay growth lowest in over three years

Starting pay levels for both permanent and temporary workers continued to increase during March. Higher pay generally reflected efforts to attract better candidates. However, amid an upturn in candidate supply, rates of pay growth continued to slide. Overall, permanent staff salaries rose at the weakest rate in over three years, whilst for temp wages the increase was the slowest in four months. In both instances, growth rates were also below their respective survey trends.

Further decline in staff demand signalled

Latest data showed that demand for all workers fell for a fifth successive month in March. Although the rate of contraction was softer than in February, it remained historically marked. Permanent staff demand continued to fall at a noticeably faster rate than for temp workers, which again fell only marginally.

Labour supply continues to increase during March

March saw a rapid and accelerated increase in the availability of staff. Latest data marked the thirteenth successive month that growth has been registered, and the latest rise was the steepest recorded since last November. Higher volumes of redundancies and cost cutting at firms reportedly led to an increase in candidate availability. Permanent and temporary staff availability both increased sharply.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Staff Availability

Overall candidate supply increases at steepest pace for four months

Overall candidate numbers continued to increase during March, extending the current period of growth to 13 months. Moreover, a rise in the seasonally adjusted Total Staff Availability Index to 60.2, from 57.3 in February, pointed to the strongest rise in staff availability since last November.

Latest data revealed that both permanent candidate numbers and the supply of temp workers increased during March.

Permanent worker availability increases at sharper rate

Permanent staff availability increased again in March, marking a thirteenth successive monthly increase. Moreover, the rate of growth picked up quite noticeably, reaching its highest level since last November. There were reports from panellists of increased redundancies, company restructuring and reduced vacancies. These factors led to an increase in the supply of people looking for a permanent position.

There was an increase in permanent labour availability across all four English regions in March. The steepest growth was seen in the North of England.

Faster rise in temp candidate numbers signalled

Temporary candidate availability also rose for a thirteenth successive month in March. The rate of growth also accelerated, reaching its highest level since last November. Recruitment consultants reported less roles being available. Moreover, there was evidence of an increased number of redundancies as firms engaged in cost cutting against the backdrop of an uncertain economic environment.

Whilst all four English regions recorded increases in temp candidate supply, there was some variance in rates of growth. London registered a considerable rise in availability. In contrast, growth was much more modest in the Midlands.

Pay Pressures

Starting salaries rise at slowest rate for over three years

Latest data showed that permanent staff salaries continued to rise in March, in line with the trend for over three years. However, the rate of increase was the lowest in the current sequence and well below the survey’s long-run average. Where pay was reported to have increased, panellists commented that companies were willing to bolster pay to attract and secure better quality candidates. An increase in the availability of workers did however serve to weigh on pay growth in the latest survey period.

Temporary wage inflation down to four-month low

Typical average pay rates for temp workers continued to rise in March, although the rate of inflation sank to its lowest level for four months and was below the survey’s historical trend. Temp pay was reported to have risen in line with greater demand for higher quality candidates and their limited supply. All four English regions registered higher temp rates, although the increase in London was only marginal. The strongest increase was again seen in the North of England.

Insights for the South of England

Permanent placements fall at quickest pace since mid-2020

In the latest UK Report on Jobs, the REC, KPMG, and IHS Markit recorded a substantial fall in permanent staff appointments, a continuing downturn in temp billings and the joint weakest rise in starting salaries in 37 months.

Commenting on the latest survey results, Emma Gibson, Office Senior Partner for KPMG Reading said:

“The labour market is clearly slowing. Businesses in the South want to invest in talent, but that confidence is being impacted by economic pressures and the rising cost of doing business.

“And while the latest survey data indicates continued weak demand in the jobs market with a sharp rise in candidate availability, relatively low levels of UK unemployment alongside falling inflation could be early signs of wider UK economic recovery.

“Many will be keeping an eye on the trends over the coming months to see whether this is a long-term concern.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Staff Availability

Supply of permanent staff expands rapidly

For the thirteenth month running, recruiters across the South of England recorded a rise in permanent staff availability in March. The rate of growth has picked up in each month since January and was sharp overall. Higher candidate numbers were widely attributed to reports of redundancies.

Sharp rise in temp staff availability

The first quarter of the year ended with a further sharp expansion in the supply of temporary candidates across the South of England, and one that was the strongest in six months. Surveyed recruiters often noted that reduced demand and the dismissal of workers drove the increase in supply of temp workers.

At Jo Thompson Recruitment, we communicate seamlessly with hiring managers, fuel collaboration by sharing information and insights. Hiring managers are time-poor, so providing pre-qualified candidates with data driven insights and creating the resilient, agile and diverse workforce you need to succeed is a major win.

We can support you to refine your data-driven recruitment strategy and tailor your approach to each target audience. Help you make informed talent decisions around diversity and hidden talent pools. To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.