Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“While some sectors are still finding it difficult to recruit people with the right skills, the overall pool of available candidates is growing as companies are still faced with tough decisions on their headcount. This has led to a softening of salary inflation, which dropped to its lowest point since February 2021. The Bank of England will likely be encouraged by this easing in pay pressures, which could strengthen the case for a further cut in interest rates in the upcoming November meeting.

“The slowing of hiring activity seen in September is to be expected as businesses apply the brakes on recruitment ahead of the Budget and wait for clarity on future taxation, business, and economic policy. The Government needs

to continue to give chief execs confidence in the UK’s macroeconomic conditions and the country’s route to stronger growth.”

Neil Carberry, REC Chief Executive, said:

“This is a picture of a jobs market waiting for a signal. Recruiters report that projects in client businesses are ready to go, but confidence is not yet high enough to push the button. The market for permanent jobs declined in September but more slowly than in the month before, while the temporary hiring market was more resilient and grew in some places. Private sector vacancies are close to flat, which also suggests businesses are holding position.

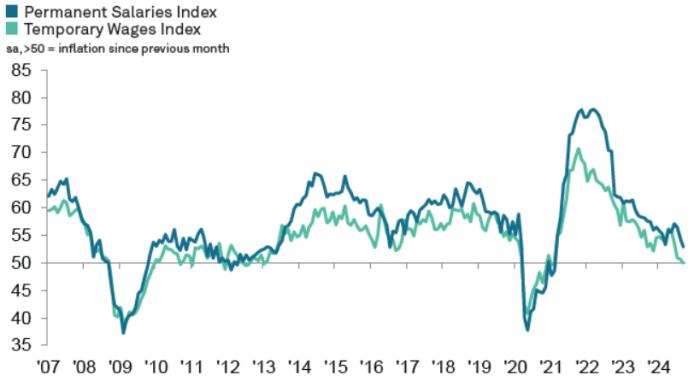

“Pay continues to moderate and is now below its long-term trend. This should add to the willingness of the Bank to become more activist on interest rate cuts, as the Governor hinted last week. This would be a big boost to business.

“But eyes are also on the government. The Chancellor has a huge opportunity at the Budget to drive confidence in our economy. Firms want a clear industrial strategy that goes beyond a sector-by-sector approach, focusing on key growth enablers such as the workforce, infrastructure, access to capital, and the tax system. They also need clarity on the changes to employment law that are planned – as uncertainty in this area is also slowing employer confidence right now.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for September are:

Staff appointments continue to fall

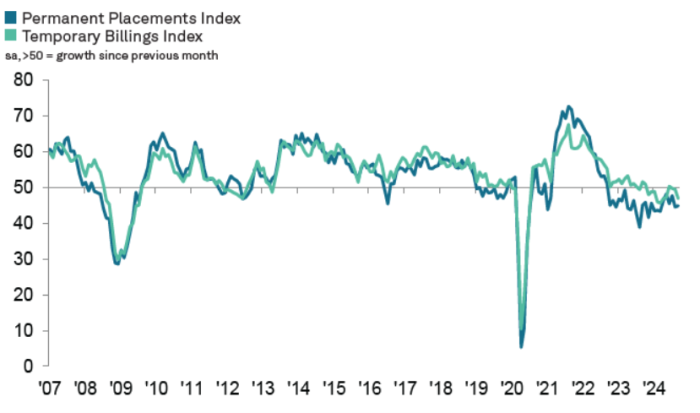

The latest KPMG/REC Report on Jobs survey indicated a further fall in the number of permanent staff placements. The downturn in appointments now extends to two years, although the latest contraction was slightly softer than August’s five month record. Uncertainty in the outlook, including around government policy ahead of late October’s Budget, meant companies were cautious in their hiring activity. Temp billings also declined in September, and at the steepest rate since April.

Permanent pay inflation softens during September

Although there remained reports of shortages in suitable candidates, which helped to boost pay rates, permanent staff salary growth eased again in September. It was the third month in a row that salary inflation has fallen, and September’s reading was the lowest since February 2021. A greater number of candidates and reduced demand helped to limit pay growth, according to panellists. Temp rates meanwhile were fractionally lower, putting an end to a three-and-a-half-year run of inflation.

Vacancy numbers continue to decline

Latest survey data showed an eleventh successive monthly fall in staff vacancies. Moreover, the pace of contraction accelerated to the steepest since March. Both permanent and temp vacancies declined at similarly modest rates during September.

Staff availability rises markedly

Amid reports of increased redundancies and lower demand for workers, the overall availability of staff to fill positions increased again in September. Overall growth was again steep, despite easing to its lowest level since February. Similar trends were seen for both permanent and temporary workers.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Insights for the South of England

Downturn in hiring activity continues

The latest UK Report on Jobs from REC, KPMG, and IHS Markit highlights continued declines in both permanent placements and temporary billings, reflecting a weakening demand for labour. The pace of this deterioration has accelerated, with employers scaling back on hiring amid economic uncertainty. At the same time, the supply of workers has expanded significantly, as candidate availability increases, signalling a shift in the job market dynamics as recruitment trends soften.

Commenting on the latest survey results, David Williams, KPMG UK Bristol office senior partner:

“The South of England’s labour market is experiencing a downturn, with hiring activity slowing down and redundancies increasing. While this has led to a rise in available candidates, it signals a challenging job market for job seekers in the region.

“Uncertainty around potential changes to employment policies ahead of the Budget may be forcing businesses to apply the brakes on recruitment until there is further clarity. In the meantime, candidates with in-demand skills – particularly professional services, IT and medical industries – will most likely still find opportunities.

Staff Availability

Growth in permanent staff supply cools notably

The South of England saw a sharp rise in permanent staff supply in September. While the rate of expansion eased to a 12-month low, it was sharp overall. Where an upturn was noted, recruiters widely commented on redundancies.

Rapid, albeit slightly softer rise in temp staff supply

A seventeenth consecutive monthly rise in temp staff supply was noted across the South of England in September. The rate of growth eased to a seven-month low but was rapid and the fastest of the four monitored English regions. A lack of contracts, redundancies and increased preferences for supplementary incomes was said to have driven up the supply of temp workers.

Special Feature

This section features data from the Recruitment and Employment Confederation

Low Pay Commission – 25 Years On from the Introduction of the UK Minimum Wage

As businesses and workers await the Low Pay Commission’s (LPC) decision on the National Minimum Wage (NMW) in late October, it’s a good time to reflect on its history and the current economic context. Since its introduction by the Labour government in 1999, the NMW has played a critical role in protecting low-paid workers. Over the past 25 years, the adult minimum wage has risen by 70% in real terms. In the last two years alone, it has increased by more than 20%.

A key milestone was the introduction of the National Living Wage (NLW) in 2016, which applies to workers aged 21 and over. In April 2024, the NLW was raised by nearly 10%, reaching £11.44, the highest level since its creation. While this increase helps workers manage rising costs, it also presents some challenges for businesses that are already facing significant pressures.

The Office for National Statistics (ONS) reported that in 2023, the proportion of low-paid jobs (based on hourly pay) fell to a record low of 8.9%. This is an encouraging sign, indicating that wage growth is making a tangible difference in reducing low-paid work. Increased wages have been a continuing issue for many firms, According to the latest KPMG and REC Report on Jobs, starting salaries for permanent jobs continued to increase in August, extending the run of increases to three and a half years.

However, recent REC data reveals that the number of job postings for roles typically paid at or near the NLW has significantly declined. In May 2023, over 800,000 job postings were available for positions with a median wage below £12/hour. By May 2024, that figure had dropped to 512,000.

Some of the largest decreases in occupations when comparing May 2023 to May 2024 include Delivery Operatives, Drivers and Couriers, where demand fell by 65% in May 2024, and roles like Data Entry Administrators (-59.1%) and Call and Contact Centre roles (-51.9%), where postings dropped by over 50%.

Smaller declines were seen in Road Transport Drivers (-2.5%) and Window Cleaners (-9.2%). In contrast to 2023, no professions at this pay level saw increased demand in 2024.

The challenge for the LPC is to strike a balance between increasing wages to help workers cope with rising living costs and ensuring businesses can manage these wage hikes without compromising their long-term sustainability. As inflation continues to pressure both businesses and employees, the LPC’s decisions will be crucial in shaping the future of work and pay in the UK.

At Jo Thompson Recruitment, we communicate seamlessly with hiring managers, fuel collaboration by sharing information and insights. Hiring managers are time-poor, so providing pre-qualified candidates with data driven insights and creating the resilient, agile and diverse workforce you need to succeed is a major win.

We can support you to refine your data-driven recruitment strategy and tailor your approach to each target audience. Help you make informed talent decisions around diversity and hidden talent pools. To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.