Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“Businesses continue to hold back on recruitment, leading to permanent and temporary placements falling steeply again in January.

“While firms are still willing to pay for top talent, increased staff availability weighed on pay growth. This cooling may have encouraged the Bank of England’s decision to cut rates last week.

“It is unlikely that we will see any significant improvements in the survey data over the near term, as hiring stays muted and staff availability continues to rise. Yet business leaders are ready for growth signals and gradual rate cuts could start to translate into greater confidence to plan and invest.”

Neil Carberry, REC Chief Executive, said:

“Businesses entered the year uncertain on the growth path, and that has driven a “wait and see” approach to hiring. Around the country, REC members report that clients have plans and are hopeful for the year ahead – but firms are slowing investment until they see more momentum in the economy. Last week’s move on interest rates was timely as a way of boosting confidence. The more central role of growth in Government thinking since the Chancellor’s speech last month will also help. But it takes time, and real action, to build business confidence. An autumn of fiscal gloom, difficulty navigating significant upcoming tax rises and little progress on the practicalities of a costly new approach to employment rights are all acting as brakes on progress. As well as the monetary stimulus to growth, it’s time for greater clarity on how the Government will use its industrial strategy to drive the growth of the whole economy.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for January are:

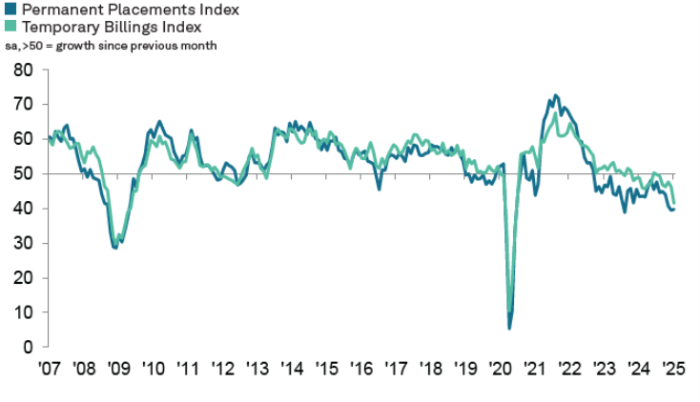

Fastest decline in temp billings since mid-2020

The first KPMG/REC Report on Jobs survey of 2025 revealed a further steep drop in permanent placements as falling demand for workers and a general air of business uncertainty weighed on the UK labour market. Extending the current period of contraction to 28 months, January’s survey showed that permanent placements declined at a pace little changed on December’s 16-month record. There were again reports of a reluctance to hire staff given upcoming changes to the cost of employing staff. Temp billings meanwhile fell to the greatest degree in over four-and-a-half years as the pace of contraction accelerated noticeably since the end of 2024.

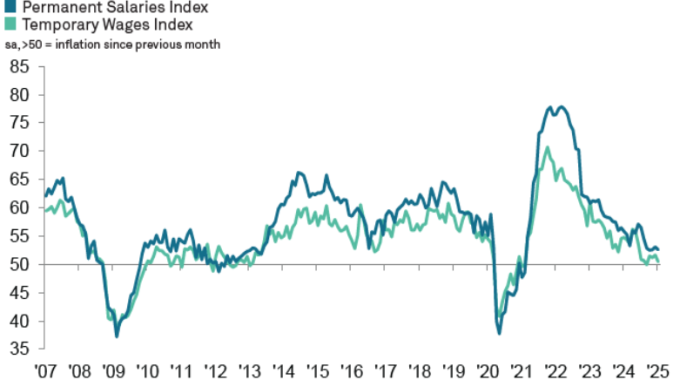

Pay inflation weakens at the start of 2025

Permanent salary growth softened during January, easing to a modest level that remained amongst the slowest in the current sequence of inflation (that began in March 2021) and was well below the historical trend. Although firms were again willing to pay higher starting salaries for good quality candidates, an increased availability of staff tended to weigh on pay growth. Temp rates rose to an even slower degree, with inflation marginal and the weakest in the current four-month growth sequence.

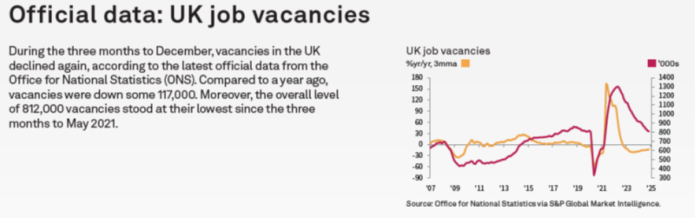

Vacancies continue to tumble

Demand for staff continued to decline noticeably during January, overall falling to the greatest degree since August 2020. Vacancy numbers fell especially sharply for permanent workers, with the rate of contraction accelerating for the fifth successive month to a near four-and-a-half-year peak. That said, temp workers also fell at a steeper pace (the sharpest recorded by the survey since June 2020).

Staff availability continues to rise, but to slower degree

Amid widespread reports of a growing volume of redundancies at firms in January – linked in turn to challenging market conditions for businesses – both permanent and temporary staff availability increased. However, the overall rate of growth softened since December to their slowest in just under a year.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Insights for the South of England

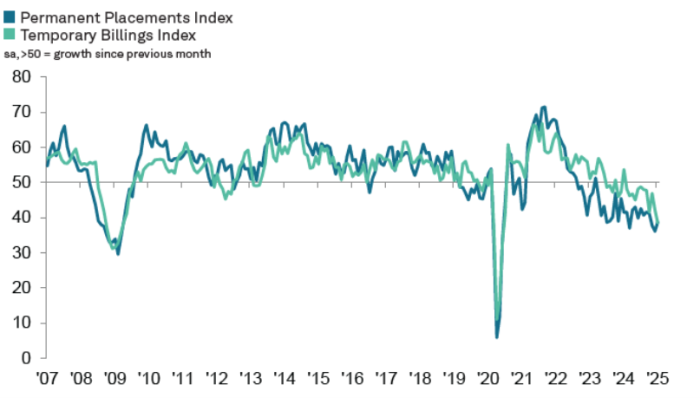

South of England starts the year with further fall in recruitment activity

The latest UK Report on Jobs by the REC, KPMG, and IHS Markit highlights a continued downturn in permanent new appointments, with starting salaries falling for the third consecutive month and demand for workers declining at the sharpest rate since the pandemic.

Commenting on the latest survey results David Williams, Bristol Office Senior Partner at KPMG UK, said:

“January brought a fresh set of challenges for the job market in the South of England, with a notable drop in both permanent and temporary placements. Sluggish growth continues to cast a shadow over hiring decisions, and employers are treading carefully in light of the upcoming increase to National Insurance contributions.

“Notably, the South of England was the only region to see a decline in starting salaries, which could prove a silver lining for businesses in the region. This dip in the cost of hiring should allow companies to bring in talent at more budget-friendly levels, and could help to ease the growing pool of candidates actively looking for work.”

Neil Carberry, REC Chief Executive, said:

“Businesses entered the year uncertain on the growth path, and that has driven a “wait and see” approach to hiring. Around the country, REC members report that clients have plans and are hopeful for the year ahead – but firms are slowing investment until they see more momentum in the economy.

“Some good news for the region is that for the first time in 11 months, the South of England did not register the most severe reduction in new permanent joiners of the English regions.

“Last week’s move on interest rates was timely as a way of boosting confidence. The more central role of growth in Government thinking since the Chancellor’s speech last month will also help. But it takes time, and real action, to build business confidence. An autumn of fiscal gloom, difficulty navigating significant upcoming tax rises and little progress on the practicalities of a costly new approach to employment rights are all acting as brakes on progress. As well as the monetary stimulus to growth, it’s time for greater clarity on how the Government will use its industrial strategy to drive the growth of the whole economy.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Staff Availability

Sharp, albeit softer expansion in permanent staff supply

As has been the case in each month since March 2023, the South of England noted a drop in permanent candidate availability in January. The rate of growth was sharp, albeit the weakest in four months. A combination of redundancies and low demand was said to have pushed up the supply of permanent candidates.

The South of England, along with their counterparts in the North recorded the joint-weakest rate of expansion in permanent staff supply of the four tracked English regions.

Cooling but still rapid rise in temp staff availability

A rapid rise in temp staff availability was recorded across the South of England in January, thereby stretching the current run of expansion to 21 months. The latest upturn was attributed to an increase in redundancies, economic concerns and project cancellations.

Nevertheless, the rate of expansion was the slowest since July 2023 and the weakest among the four monitored regions in England. The Midlands also experienced a reduced rate of expansion.

Special Feature

This section features data from the Recruitment and Employment Confederation

A Look at Employers’ Confidence Throughout 2024

Demand for workers has declined, it hasn’t disappeared.

In today’s fast-paced business world, employers must stay sharp and adapt to ever-changing economic conditions when making key hiring and financial decisions. Economic confidence plays a crucial role, shaping the strategies that drive growth and success.

Since the COVID-19 pandemic, employers have faced various challenges; factors such as inflation, interest rates, the cost-of-living crisis and supply chain disruptions continue to shape employer confidence.

But there are grounds for optimism for 2025. Amid rather doomster forecasts for the UK economy based on fiscal constraints and stagnant growth, the Chancellor has unveiled plans to initiate new infrastructure projects, including railways and reservoirs, connecting high-productivity regions such as Oxford and Cambridge. The Government continues to focus on supply-side improvements, such as reducing regulation and overcoming planning approval obstacles, and there are even hopes of monetary policy adjustments. These efforts aim to stimulate economic activity and address regional disparities.

And the inconvenient truth is that employers are not as downbeat as the doomsters suggest – you just need to know where to look.

Shape of 2024:

Throughout 2024, confidence trends in the UK economy showed some improvements despite ongoing challenges. The REC’s Jobs Outlook from October to December 2024 showed that whilst still negative, confidence in the UK economy improved by three points to net: -25, compared to net: -28 in the adjusted three months to October. Notably, confidence surged in December to net: -12 after a period of heightened concern in November (net: -39).

Yet, employers’ confidence in making hiring and investment decisions fell three points in the same quarter (from an adjusted net: -2 to net: -5). And this was in stark contrast with the near-term peak of net: +16 in the three months to June 2024. The drop in employers’ confidence was driven by heightened concerns in November when confidence fell to net: -17 before rebounding to net: +2 in December.

Regionally, confidence was highest in London and the Midlands where hiring intentions remained relatively stable. In contrast, employers in the South (outside London) reported a more cautious outlook, with some firms scaling back recruitment plans due to cost pressures and economic uncertainty.

Looking into 2025 and beyond:

Looking ahead, economic conditions are expected to improve. The REC’s Recruitment Industry Status Report (RISR) shows that real terms GVA growth is projected at 2.7% in 2025, followed by 3.2% in 2026 and 3.5% in 2027. The sector’s sharp contraction in 2023 provides greater room for recovery as economic conditions shift for the better.

Encouragingly, survey respondents expect an average 1.7% growth in recruitment fees and a 1.4% increase in client volume over the next 12 months. But this is lower than last year’s expectations, which predicted 3% growth in both areas.

Whilst employer confidence remains cautious, the overall outlook suggests gradual improvements in economic conditions and hiring intentions in the years ahead.

Businesses that focus on adaptability, skills development, and strategic workforce planning are best positioned to capitalise on emerging opportunities as the economy stabilises.