Jo Thompson Recruitment contributes to the Report on Jobs, a comprehensive guide on the UK labour market that is drafted by KPMG and the Recruitment & Employment Confederation (REC), compiled by IHS Markit. The monthly report is built upon survey data from recruitment consultancies and employers, who share insights on the latest and most pressing labour market trends for the UK.

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

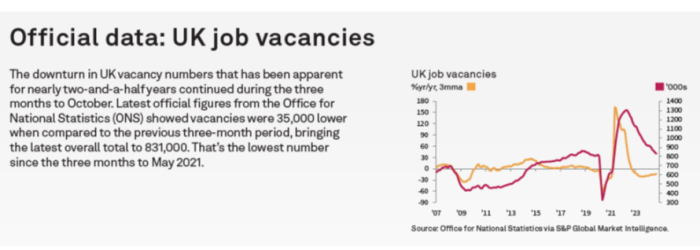

“Businesses are having to weigh up the prospect of increasing employee costs following the Budget, which has led to an accelerated slowdown in hiring activity across the board. While the data was already heading in that direction, permanent placements saw their steepest reductions in over a year last month, and temporary roles also saw a fifth consecutive decline.

“This slowdown, alongside a growing availability of candidates in the market could put more downward pressure on wage inflation, which remained largely unchanged on last month’s 44-month low. This trend will be encouraging for the Bank’s monetary policy committee ahead of the next meeting later this month, although it may not be enough to counter wider inflationary pressures we are seeing in the economy.

“However, the prospect of further rate cuts through 2025, alongside the Government’s investment plans, both point to improved growth in the near term. This should give businesses greater confidence which may help stabilise the labour market.”

Neil Carberry, REC Chief Executive, said:

“It should be a surprise to no-one that firms took the time to re-assess their hiring needs in November after a tough Budget for employers. The drop in vacancies was led by private sector permanent roles, and slower permanent recruitment billings across the month also reflected this trend. The real question now is whether businesses will return to the market as they go into next year with greater certainty about the path ahead. The resilience of temporary recruitment offers some hope – private sector temporary hiring activity was almost flat across the country, by comparison with the drop in permanent hiring, and there was growth in some regions. Firms are likely to rest more on temps while they manage the current uncertainty, and that only serves to emphasise again the value of flexible forms of work to companies and people who need to find work quickly after redundancy. For policymakers, ensuring new regulations support rather than weaken our flexible jobs market is vital – especially after the Budget. Ensuring rules introduced by the Employment Rights Bill are tailored to protect agency and temporary work really matters for people.”

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Executive Summary

The Report on Jobs is unique in providing the most comprehensive guide to the UK labour market, drawing on original survey data provided by recruitment consultancies and employers to provide the first indication each month of labour market trends.

The main findings for November are:

Staff appointments tumble in November

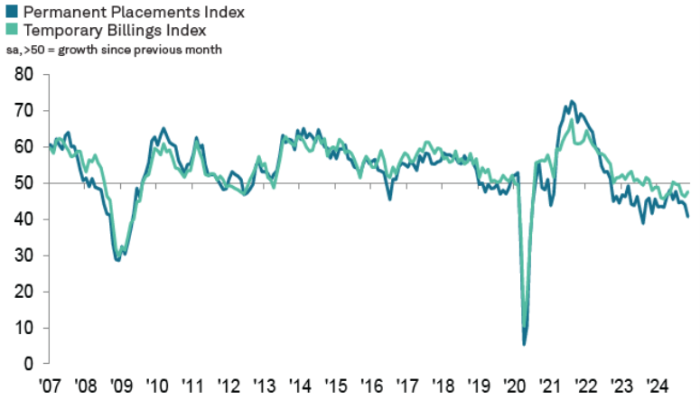

November’s KPMG/REC Report on Jobs survey signalled an accelerated decline in the number of people placed in permanent positions by UK recruitment consultants. Overall, the fall was the steepest recorded by the survey since August 2023 amid widespread reports of reduced vacancies. Many respondents signalled that the government Budget in late October had led to uncertainty and the reassessment of staffing needs by clients. Similar factors led to a fifth successive decline in temporary staff billings.

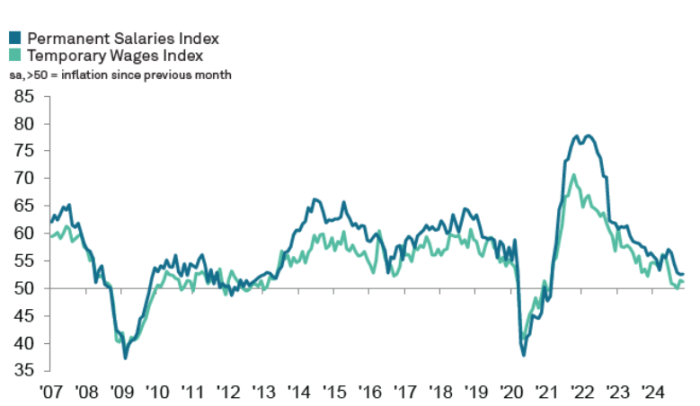

Salary growth limited by reduced demand for staff

Permanent salary growth was little changed on October’s 44-month low during November. Whilst skilled candidates were often reported to be able to command higher salaries, pay growth tended to be limited by higher candidate availability and reduced demand for staff. Temp pay rates similarly increased only modestly, and to a slightly lesser extent than in October.

Steepest reduction in vacancies since August 2020

Vacancy numbers declined at a sharp and accelerated pace during November. It was the thirteenth successive month in which a fall in staff demand has been registered, and the latest drop was the greatest recorded for over four years. An especially severe drop in demand was seen for permanent workers.

Sharper increase in staff availability during November

Amid reports of a growing number of redundancies at clients, recruitment consultants signalled the steepest rise in overall staff availability for three months in November. Latest data signalled similarly sharp growth rates for both permanent and temporary worker supply.

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Courtesy of IHS Markit, KPMG, and the Recruitment & Employment Confederation

Insights for the South of England

Hiring activity falls further in November

The latest UK Report on Jobs by the REC, KPMG, and IHS Markit highlights the sharpest decline in new permanent joiners since March, a drop in starting salaries for the first time in 45 months, and a rapid worsening in demand for workers.

Commenting on the latest survey results, Emma Gibson, KPMG UK Reading office senior partner, said:

“The job market in the South is feeling the strain with an accelerated decline in permanent vacancies, the sharpest cutback in over four years. This reflects the cautious approach businesses are taking following the Budget’s announcement of higher National Insurance and increased hiring costs.

“That being said, with an oversupply of candidates, there is an opportunity for employers in the South to access a broader talent pool at more manageable salary levels. Meanwhile job seekers will need to stay flexible and focus on upskilling to stand out in an increasingly competitive market.”

Staff Availability

Sustained and sharp rise in permanent staff supply

The South of England recorded its twenty-first consecutive monthly increase in permanent candidate availability during November. Although the rate of growth moderated slightly compared to the previous month, making it the weakest uptick among the four monitored English regions, it remained sharp overall. Respondents reported that redundancies led to a higher volume of active job seekers.

Rapid rise in temp candidate availability

In November, there was an increase in the supply of temporary staff across the South of England. This rise was attributed to decreased demand for temp workers and redundancies, which led to a larger pool of candidates in the job market. Although the pace of expansion in the South cooled compared to previous months, it remained rapid overall.

Special Feature

This section features data from the Recruitment and Employment Confederation

AI’s (artificial intelligence) role in the workplace is growing, but its application remains uneven across industries and job functions.

As AI continues to weave its way into the fabric of work practices, its adoption across industries highlights both opportunities, such as improved efficiency in tasks such as resume screening, managing schedules and creating social media engagement. It also comes with challenges, including ethical concerns, lack of trust in large language models, and limitations in handling interpersonal or nuanced tasks, emphasising the need for a balanced approach that combines innovation with robust ethical oversight.

According to the ONS’ Business and Insights Conditions Survey (BICS) approximately one in six (16%) of UK businesses report using at least one AI technology. Spam filters are the most common application (11%), followed by chatbots (4%), facial recognition (3%), and voice assistants (1%). The same report found that businesses with less than 10 employees were most likely to report that the question about current AI use was not relevant to them (79%), compared with businesses with the largest workforces of more than 250 people (48%).

This presents both opportunity and areas for closer scrutiny.

PWC’s recent survey found that adoption of AI use is most prominent in the legal and IT sectors, where employers offer up to a 14% wage premium for AI-related roles. As you may expect in turn, AI adoption tends to cluster in regions with higher concentrations of tech and professional services industries, such as London and the South East of England. But manufacturing hubs in the Midlands and North are also increasingly exploring AI for operational efficiencies.

The Recruitment and Employment Confederation’s recent Recruitment Industry Status Report’s (RISR) special feature focuses on how and why recruitment agencies use AI.

The RISR report found that more than 40% of UK recruiters currently use AI, with an additional 26% planning to adopt it within the next year. Most recruiters utilise AI for early-stage activities, such as creating job descriptions (used by 90% of AI adopters), which help improve visibility and audience reach. But its use drops significantly in later stages of the recruitment process, such as onboarding (7%) and interview scheduling (7%).

The feedback on AI tools highlights both their advantages and limitations. Recruiters report that resume screening (45%) and talent acquisition tools (39%) are effective for handling large volumes of data. On the other hand, AI tools are seen as less effective for tasks requiring interpersonal engagement, such as improving candidate experience (25%) or conducting assessments that evaluate soft skills (68%).

Ethical concerns and trust issues remain significant barriers to wider AI adoption in recruitment. Sixty-one percent of recruiters cited lack of trust as a key obstacle, while 31% raised concerns about the potential for AI tools to reinforce biases. Although AI has been promoted to reduce discrimination, it can sometimes replicate or amplify existing biases in the data it is trained on.

As industries navigate these challenges, a balanced approach combining AI innovation with ethical oversight will be essential for success. Turn to interns for motivated and bright talent.

At Jo Thompson Recruitment, we communicate seamlessly with hiring managers, fuel collaboration by sharing information and insights. Hiring managers are time-poor, so providing pre-qualified candidates with data driven insights and creating the resilient, agile and diverse workforce you need to succeed is a major win.

We can support you to refine your data-driven recruitment strategy and tailor your approach to each target audience. Help you make informed talent decisions around diversity and hidden talent pools. To discuss how Jo Thompson Recruitment can assist you with your resourcing needs, please email us at info@jtrltd.com or give us a call at 01635 918955 for further details.